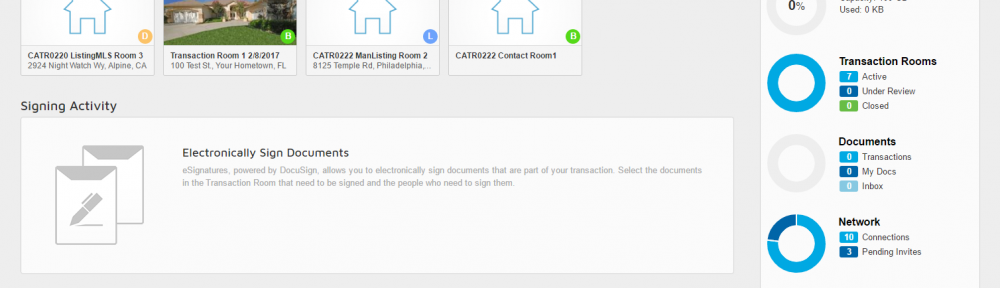

DocuSign transaction room website empowers organizations to smooth out complex arrangements through a safe, advanced work area that can be upgraded to their particular work process needs. You can consider a room to deal with every one of the errands, reports, individuals, and endorsements associated with multi-step or multi-party exchanges, like purchasing a house or applying for a home loan.

How to know whether you need the transaction room

At the point when intermediaries, specialists, and exchange organizers need to finish up desk work, complete manual agendas, and pursue down refreshes on agreement status, it can dial back bargains and present the potential for human mistake. Such shortcoming likewise keeps specialists from investing more energy with customers and developing their business. Overseeing land exchanges utilizing paper-based cycles makes critical difficulties for a business:

- Absence of normalization. Every specialist and exchange organizer could be involving an alternate methodology for overseeing land records, leaving merchants without perceivability into where they can further develop cycles and care staff.

- Consistence hazard. At the point when realtors should fill in so many various structures, they can undoubtedly neglect a field or enter erroneous data. Without a focal view into exchanges, the business can’t check that every one of the right advances has been finished.

- Siloed frameworks. In any event, when a financier is utilizing online endorsement, without a focal area to oversee records and a start to finish coordinated work process that associates every one of your frameworks from lead to close, specialists can get disappointed and may at last move to a business that offers a more consistent interaction.

How secure data services can help

An exchange management service can tackle these business challenges and speed up the speed of arrangements which implies more cash for the specialist and financier. With DocuSign Rooms specialists and exchange, organizers can set up a solid, virtual room wherein they complete each progression of the exchange interaction, from finishing up structures and assembling marks to finishing agent agendas and endorsements.

An adaptable and reusable format for each room guides specialists through the means to finish an exchange. This permits intermediaries to normalize required records and set assignment records, due dates, and updates. Normalization likewise further develops consistency so you can rest soundly around evening time realizing that each progression of the exchange is right, finished, and auditable.

Conveying the advanced home loan insight

Contract banks are putting intensely in computerized change drives to speed up business processes and empower the advanced encounters that borrowers and colleagues progressively anticipate. Despite the fact that numerous loan specialists have carefully improved a few pieces of the home loan process, the actual interaction regularly remains to a great extent separated and manual.

It’s no big surprise. A home loan is one of the biggest, generally, mind-boggling, and longest-enduring customer monetary instruments. The cycle to convey a home loan includes:

- the trading of many pages of archives with borrowers;

- teaming up with many outside members like escrow, title, settlement, legitimate, legal official, and realtors;

- consenting with an assortment of arrangements and assents;

- complying to region, state, and government guidelines for the exchange;

- keeping touchy monetary reports moving and all members on task.

The uplifting news is you don’t really have to tear out and supplant your current systems. You need to concentrate on later speculations that empower the choice of a totally computerized contract process.